If you would like to go paperless and avoid fees related to administrative and postage costs, please follow the steps below.

- Login to your online account

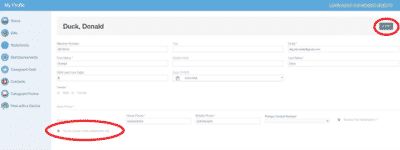

- Go to ‘My Profile’ in the top right corner

- Under your profile settings, click the 'Edit' box in the top right corner

- Select the checkbox that says, ‘You’ve chosen online statements only’

- Click 'Save' in the top right corner

- Please finish setting up your account by clicking the validation link sent to your email

If you don’t have an online account, setting one up is easy. Please go to portal.careguard.com/#/login and choose to register to create a new account. You can also reset your password here.

For information on registering for your online CareGuard account, please see: How do I sign up for the CareGuard Member Portal?

Thank you for helping us in our mission to go paperless!