Medicare Set Aside Accounts

A Medicare Set Aside account is just an organized way to show Medicare that you took their interests into consideration at the time of settlement.

A Medicare Set Aside account is a portion of your settlement set aside to cover all future injury-related medical expenses for you that would normally be paid by Medicare. When the Medicare Set Aside account funds exhaust, Medicare will step in as primary payor granted you have reported your use of the funds properly to Medicare and, of course, that you are enrolled in a Medicare plan.Medicare Set Aside

?A Medicare Set Aside is never required, but many parties to a settlement choose to specifically put together an allocation report showing items that are related to the injury and would be covered by Medicare.

The report is called the Medicare Set Aside. Medicare Set Asides can be submitted to Medicare for review and approval if they are significant to meet Medicare's review thresholds; in any event, the process of review and approval is voluntary. Getting approval just means Medicare has validated the amount set aside is accurate.

Medicare Set Aside

AccountsWe are the industry leader in helping injured parties manage their Medicare Set Asides after settlement.

When you settle the medical portion of a claim and you are eligible for Medicare, a Medicare Set Aside Account can be established. If a case settles with a Medicare Set Aside, the you have a responsibility to report injury-related purchases annually to Medicare, in order to protect your Medicare benefits. Ametros is the industry leader in managing Medicare Set Aside funds, providing full professional administration as well as self-administration tools.

Medicare requires that all Medicare Set Asides be administered following these five main guidelines:

- Funds must be held in an interest-bearing account

- Use the fund only for treatments related to the injury

- Use the fund only for Medicare–covered expenses

- Prepare and submit annual accounting report to Medicare

- Maintain line item detail for the duration of eligibility

If you or your attorney does not comply with this complex list of requirements, you risk being denied your benefits by Medicare.

Our Services

CareGuard was created with one goal in mind: making the post-settlement process seamless. We do this through our combination of member support and professional administration services.

CareGuard is the first fully automated solution for professional administration which gives the member insight into their spending and savings trends. Our team is experienced working with settlements that are both structured into annuities or paid out in a lump sum. We also manage funds for both Medicare Set Asides and other medical allocations.

-

Extending Medicare Set Aside Funds: Through Ametros’ discount networks you may potentially save an estimated 62% on provider visits and an estimated 28% on your prescriptions. Our team reviews every bill for possible savings, in efforts to make your funds last longer.*

-

Freedom to Treat: Members can see any doctor or provider, without Utilization Review.

-

Support: access to our team of Care Advocates.

-

Technology: A state-of-the-art online portal where members can review the status and total savings of their CareGuard Medicare Set Aside Account.

-

Reporting: With CareGuard, all reporting is handled and members are compliant with Medicare guidelines.

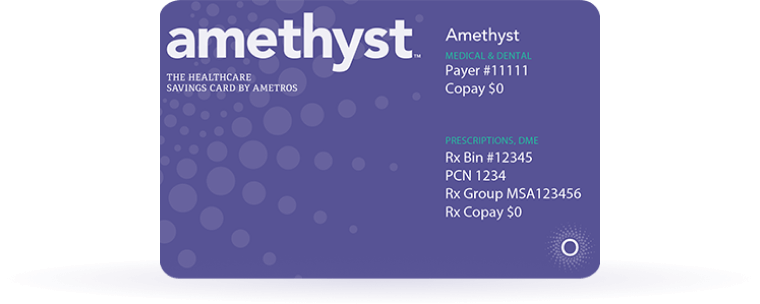

Amethyst is designed to allow you to remain in complete control of your funds, while ensuring a seamless process for both the member and facility providing services.

With Amethyst you have the ability to link your settlement funds directly to a personal bank account. The Amethyst platform functions by managing transactions, funds, and ensuring funds are available to support charges in question.

-

Savings: Estimated 21% savings on the projected pricing of your settlement, including durable medical equipment, medical treatment, and prescriptions*

-

Freedom to Treat: Members can see any doctor or provider, without Utilization Review.

-

Support: access to our team of Care Advocates.

-

Technology: A state-of-the-art online portal where members can chat, view spending trends and savings amounts.

-

Reporting: Medicare compliance support.

*Disclaimer: Any potential discounts or savings for medical treatment, including but not limited to, prescription drugs, durable medical equipment and/or healthcare items and services, are not guaranteed. Ametros has made no warranties, promises, representations or guarantees whatsoever about potential cost savings or the level of potential discounts obtained on any item, service or prescription payment. There are no assurances that prior successes or past results as to cost savings will be applicable to a Member on any of Ametros’ platforms. For additional information, please see our Terms & Conditions Page.