On April 1, the Centers for Medicare and Medicaid Services (CMS) released an update to the WCMSA Reference Guide v4.0 April 2024. Changes to the guide are outlined in Section 1.1 and include the following:

- Specific instruction to beneficiaries has been added to encourage them to use their Medicare.gov access to the portal for the most efficient method of submitting attestations (Sections 11.1.1 and 17.5) and

- The CDC Life Table link was updated (Section 10.3).

WCMSAP Portal for Electronic Attestation

In Section 17.5 Annual Attestation and Record-Keeping, CMS continues to emphasize that certain injured workers that resolve their future medical settlements have a responsibility of accounting for their Medicare Set Aside (MSA) funds. Every year, beginning no later than 30 days after the 1-year anniversary of settlement, they must sign and send a statement that payments from the Workers' Compensation Medicare Set-Aside Arrangement (WCMSA) account were made for Medicare-covered medical expenses related to the work-related injury. Failure to properly account for these expenses could lead to a Medicare denial of coverage should the MSA funds exhaust.

In Version 4.0, Section 17.5, CMS has added, “Beneficiaries can submit attestations online by accessing the portal via their Medicare.gov account…” encouraging beneficiaries to utilize their Medicare.gov account to access to the WCMSA Portal for submitting annual attestations rather than mailing.

Section 11.1.1 Benefits of Using the WCMSAP continues to outline the benefits of using the WCMSAP, which was designed to improve the efficiency of the WCMSA submission and attestation process. Beneficiaries may append additional documentation to the portal, such as missing settlement documents, and view prior attestation filings. Beneficiary instructions for accessing the WCMSAP through Medicare.gov can be found in Section 17.6.

- Medicare Beneficiaries can log into their Medicare account by going to https://www.medicare.gov/

- Beneficiaries can view information about their WCMSAP cases in the MSA (Medicare Set Aside) tab

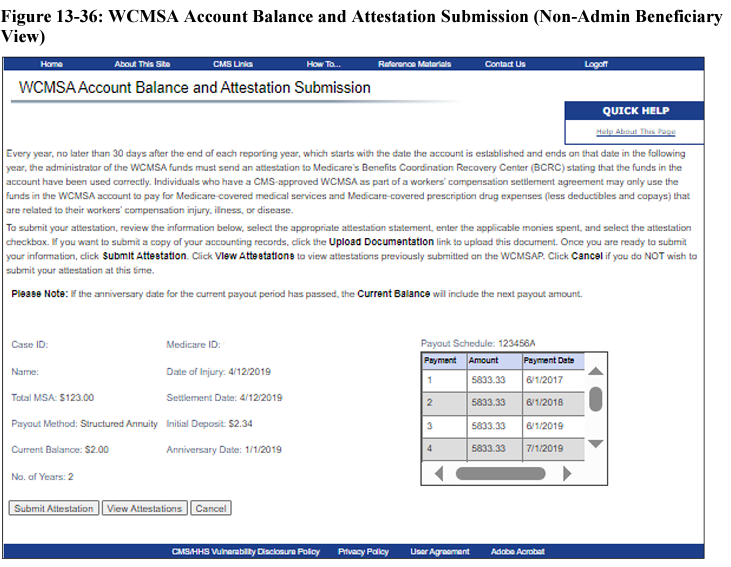

- Beneficiaries can click the WCMSA Attestation Information button on the Case Documentation page (via Medicare.gov) or Summary Information page (directly from the WCMSAP) to open the WCMSA Account Balance and Attestation Submission page (Figure 13-36)

- The WCMSAP provides Attestation Submission Verification, Confirmation and Viewing an Attestation

For further information about how to submit an electronic attestation, Beneficiaries can access the WCMSAP User Guide here.

For questions about annual attestations or annual accountings, Beneficiaries can contact the Benefit Coordination & Recovery Center (BCRC) by telephone: 1-855-798-2627

Beneficiaries also have access to the Self-Administration Toolkit WCMSA Toolkit v. 1.4, July 2023.

Medicare beneficiaries are reminded that MSA self-administration is for a lifetime. This responsibility takes time, knowledge, and comes with a risk of future Medicare denial of coverage for the work-related injury. There are some beneficiaries that can leverage Medicare.gov and the MSPRP to properly administer their MSA’s, for others, especially with complex claims, professional administration should be considered. Professional administration can ease their burden and make healthcare easier post settlement.

2021 CDC Life Table

WCMSA Reference Guide Version 4.0 also announced the new 2021 CDC Life Table to calculate adjusted life expectancies in WCMSA’s. The actuarial tables are periodically updated to account for the most recent mortality experience. COVID is a recent example of the impact on mortality experience. The Life Table is used by underwriters to evaluate an individual’s life expectancy and used in MSA’s to project the length of medical treatment over lifetime.

Rated-Age Information or Life Expectancy can be found in the WCMSA Reference Guide in Sections 10.3 and 15. Here is a link to the recent Life Table. (https://www.cdc.gov/nchs/data/nvsr/nvsr72/nvsr72-12.pdf

For more information on CMS' latest updates, you can check out our recent article analyzing an important CMS update regarding a significant expansion to the Total Payment Obligation to Claimant (TPOC) reporting process for Workers' Compensation claims involving Medicare beneficiaries or explore all our CMS updates here.

If you have questions about ensuring compliance post-settlement or how professional administration can complete this reporting on your behalf, please feel free to reach out to our team of experts.