CareGuard is a leading professional administration service that helps manage your future medical funds following a workers' compensation or liability settlement. Our goal is to make your post-settlement life easier by saving you money on doctor's visits, prescriptions, medical equipment, and more, all while coordinating your care. With CareGuard, you’ll never deal with a medical bill alone, and our experts will manage any necessary Medicare Set Aside reporting on your behalf.

Contact Us About CareGuard

-

Save on Healthcare

Ametros discounts can save you up to 60% on provider bills and 38% on all other medical expenses, allowing your medical funds to last as long as possible.* Because Ametros serve thousands of individuals receiving ongoing care, we're able to negotiate network purchasing discounts on your behalf. This means we are setting up pharmacies, doctors and equipment providers to vie for your business and offer you discounts. -

Comprehensive Medicare Set-Aside Reporting

If you have a Medicare Set-Aside, CareGuard ensures full compliance by handling all necessary reporting to The Centers of Medicare and Medicaid Services (CMS), giving you peace of mind. -

Support When You Need It

With CareGuard, you can always rely on a team of settlement and Medicare Set Aside experts available to answer all your questions about your medical treatment and any reporting responsibilities. -

Never Deal with a Medical Bill Alone

CareGuard simplifies all care-related payments. Just show your CareGuard card at your doctor's office or pharmacy, and we'll handle the rest. Please note: While CareGuard streamlines the billing process, there may be situations where members are responsible for paying a bill directly. In such cases, members can submit the invoice for reimbursement, as outlined in the Member Agreement provided at enrollment.

What is Professional Administration with CareGuard?

How CareGuard Works

CareGuard works like a traditional insurance card. Simply show your CareGuard card at your doctor's office or pharmacy. Our team will handle the rest! We are experienced working with structured settlements, lump sums, Medicare Set Asides, and other medical allocations. If you have a Medicare Set Aside, CareGuard automatically handles all required compliance reporting, submitting all reports directly to CMS.

Savings and Security after Settlement

-

Use Your CareGuard CardSimply show your CareGuard card at your doctor's office or pharmacy and you do not have to make a copay to get the treatment you need

-

Let Us Handle the RestOur team manages all aspects of your medical billing and reporting, ensuring compliance and accuracy

-

Enjoy Peace of MindWith CareGuard, you can focus on your recovery while we take care of the administrative details

What Our Members & Partners Are Saying

CareGuard Members Portal

Along the way, as you use your CareGuard card, our member portal helps provide you visibility into all of your activity and savings. You can see your account trends and call, email or live chat with our support team at any time for guidance.

When it comes to Medicare Set Asides, the portal automatically keeps your records and helps you become compliant with the CMS guidelines. If you have any questions, our team is standing by to assist you.

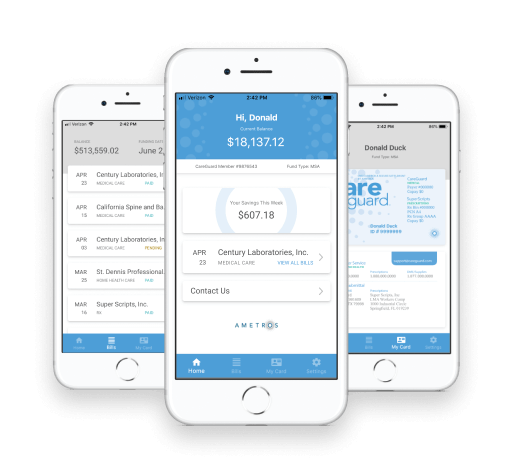

CareGuard Mobile App

Our secure app makes managing your settlement funds easy whether you are on the go or at home. Real-time access allows you insight into bill details, savings and your overall account balance. Forgot your CareGuard card at home? No problem! Use the digital version of your card at the click of a button.

Available for Android and IOS

Learn MoreOnboarding with CareGuard

Becoming a CareGuard Member

Becoming a CareGuard member is simple and stress-free. Our Care Advocates guide you every step of the way to ensure your transition is smooth and fully supported. We take the time to understand your medical and financial needs, review your settlement documents with you, and manage both structured and lump sum settlements including Medicare Set Asides and other medical allocations. We also contact your doctors and pharmacies to explain our billing process, so you don't have to. Plus, you'll have access to our secure member portal to track your expenses, savings, and account activity at any time.

Step 1

A Care Advocate calls to walk you through our process, gather your provider info, and review your current medications. Questions? Contact us at 877-275-7415.

Step 2

We contact your doctors and pharmacies to update them with the new billing information related to your injury.

Step 3

After becoming a CareGuard member, you'll receive a welcome packet in the mail within 1-2 days, including your CareGuard card and three provider instruction cards to share with your doctor, provider or pharmacy, so they understand how to bill us.