You’ve just settled your workers’ compensation or liability case. Now you need to coordinate your care and make your funds last. Let Amethyst be your trusted resource for care and savings after settlement.

With Amethyst, you have our expertise to coordinate your care after settlement, on your terms. Amethyst is an innovative tool for any future medical funds, especially Medicare Set Asides (MSAs) to help you simplify your medical care after a workers’ compensation or liability settlement. Amethyst helps you manage your expenses and maximize your funds by securing discounts on treatment and prescriptions. In the case of an MSA, Amethyst helps individuals compile any required reporting to the federal government. When you’re an Amethyst member, your experience is simple so you can focus on better living and health after settlement.

Get Started with Amethyst for Free!

-

Save on your healthcare

Through Ametros' discount networks, you can save on average 38% on your prescriptions and treatments, allowing your medical funds to last as long as possible.* -

Full MSA Reporting

If you have an MSA, Amethyst helps you compile your reporting to the Centers of Medicare and Medicaid Services (CMS). -

Never Deal with a Medical Bill Alone

Just show your Amethyst card at your doctor's office or pharmacy and Amethyst applies charges to your debit card on file. -

Support

With Amethyst, you can always rely on a team of settlement and MSA experts available to answer all your questions about your medical treatment and any reporting responsibilities.

Getting Started with Amethyst

Amethyst connects to your bank account containing your medical funds.

You will receive an Amethyst card in the mail which can be used at your doctor or pharmacy.

Visiting the Doctor or Pharmacy

We coordinate with your care team to ensure your care is handled appropriately and that all bills are sent directly to Ametros.

Using Your Amethyst Card

Using your Amethyst card is easy. Simply present your card at the doctor’s office or pharmacy and we will handle the rest. No copays, no uncertainties, no hassle.

Reviewing Your Account and Savings

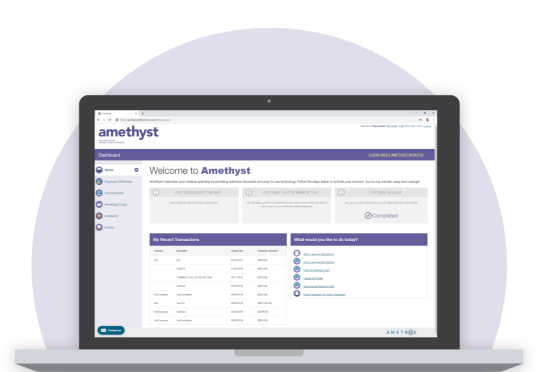

Sign in to our secure online portal to view statements, monitor your balance, and see how much money you are saving!

Savings with the Amethyst Card

At Ametros, we’re using technology to simplify your healthcare experience and drive savings. When you show your Amethyst card to a provider or pharmacy that is in one of our networks, you are tapping into the strength of our group buying power.

Because Ametros has thousands of individuals receiving medical treatments, we can negotiate network purchasing discounts on your behalf. This means we are setting up pharmacies, doctors and equipment providers to vie for your business and offer you discounts. As an Amethyst member, your experience is simple. You simply show your Amethyst card and do not have to make a copay to get the treatment you need.

The Amethyst Online Portal

With the Amethyst portal you will have transparency into your medical funds and a seamless user experience while minimizing the administrative hassle of managing medical funds. Amethyst also aids in compiling and reporting for Centers for Medicare and Medicaid Services (CMS). You will get instant reporting on expenses including interactive charts to see medical usage trends, balance by month, and claims processed over time. The portal also offers convenient support with online chat.