Ametros sought to answer a question many in the industry have asked. “What happens when a Medicare beneficiary settles their claim with an MSA, and, without reporting proper exhaustion of those funds to Medicare, attempts to use their Medicare benefit to pay for treatment that was included in the WCMSA settlement? Does Medicare have a process of denying those claims?” we asked. The answer is yes - Medicare is systematically denying MSA recipients’ claims, and with steady frequency.

With data provided by ResDac, a CMS contractor, Ametros analyzed data of Medicare beneficiaries who had been denied claims reimbursement because there was a different primary payer that should have been used. The data analyzed was from 2018–2020 and was a limited data set of Carrier Line Files that Medicare produces each year with a data partner. We then looked at other claims data, such as the amount charged and the total number of beneficiaries who had at least one claim denied.

Unfortunately, Medicare claim denials do happen after settlement, despite several misconceptions about the importance of complying with Medicare’s requirements. Our findings are published in A Study of CMS Policy on Treatment for Injured Workers with a Medicare Set Aside (MSA).

A Little Background

MSAs are among the most complex – and daunting – responsibilities of stakeholders trying to help injured workers settle their claims. Someone who is or will soon be a Medicare beneficiary must ensure Medicare does not pay for medical treatment that should be the responsibility of a third party, including settlement funds. Failure to do so puts the injured worker at risk of jeopardizing future Medicare coverage. Medicare makes it abundantly clear how this scenario can occur.

Medicare states in the WCMSA Reference Guide, “If payments from the WCMSA account are used to pay for services other than Medicare-allowable medical expenses related to medically necessary services and prescription drug expenses for the [workers’ compensation] settled injury or illness, Medicare will deny all [workers’ compensation] injury-related claims until the WCMSA administrator can demonstrate appropriate use equal to the full amount of the WCMSA.” WCMSA Reference Guide, v3.5, Sec. 17.3. “Medicare may also refuse to pay for future medical expenses related to the [workers’ compensation] injury until the entire settlement is exhausted.” Id. at Sec. 3.0 and see also Sec. 2.3 and 42 CFR 411.46(a).

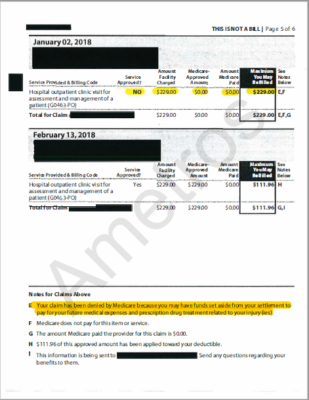

Having an MSA can be difficult for injured workers to understand in the context of their injury, which is why professional administration is recommended by CMS, especially since treatment may be needed at any point in the future. Without the help of experts managing their future medical funds, individuals risk receiving denial letters for their treatment, such as the as the following examples.

Findings

“There was a significant growth in denied claims between Q1 of 2018 and Q4 of 2020, which could potentially mean that more beneficiaries with a WCMSA were seeking treatment,” according to the study. “There was also a large drop-off right at the beginning of the COVID-19 pandemic, likely because of treatment restrictions to only those with life-threatening issues. Interestingly, despite fewer claims being denied in recent quarters, the dollar amount has remained steady.”

We looked at various aspects of the denied claims over the three-year period, including the number of denied claims, total unpaid claims in dollar amounts, and the individual number of beneficiaries affected:

The average number of denied claims per beneficiary was 5, while the average cost of each denied claim was $2,376. We also looked at the numbers in various states. Of the 16 states included, California had by far the highest number of denials:

- 2018: 12,600

- 2019; 13,720

- 2020: 11,640

Our study indicates, “Almost a third of all denials were in California, the most populous state, which has a robust workers’ compensation claim volume. Less populated states like Indiana, Colorado, and Maryland also had a substantial amount of denied claims.”

We also noted a distinct correlation between states with a large volume of claims and a high number of post-settlement claim denials. Nevertheless, the researchers found the Medicare denials were nationwide.

Our data shows that Medicare is actively monitoring claims and that beneficiaries with a WCMSA should use the funds in compliance with CMS’ WCMSA guidelines. Otherwise, their claims for related treatments will be denied. This is not isolated to certain states; it is happening across the country to thousands of beneficiaries.

Implications

After a claim settles, it is the injured worker’s responsibility to comply with Medicare’s guidelines. There are a variety of reasons as to why Medicare would deny a claim:

- Their provider could have billed their Medicare benefit when they should have billed the beneficiary or their administrator directly

- The injured worker could have been confused as to whether or not they should use their Part B benefit or their WCMSA funds for a particular treatment

- Or in the case an injured worker exhausted their MSA funds, they may not have adequately provided an accounting of their WCMSA expenses, which would generate the denial letter

“No matter what the explanation, a consistent number of the injured workers we work with every day when settling these cases will be denied treatment by Medicare because they have not properly set up or used their MSA settlement funds,” the study says. “This data should be compelling to stakeholders to ensure that injured workers understand how to handle their WCMSA funds at the time of settlement properly.”

Jeremy M. Buchalski

Attorney at Wilson Elser Moskowitz Edelman & Dicker LLP

“As a workers’ compensation defense attorney, it can sometimes be easy to ignore the potential risks of Medicare denying payment of medical expenses for an injured worker because by the time this occurs, the claim has been settled.” However, the risks are real and the failure to appreciate them could affect the ability of employers, carriers, and third-party administrators to settle claims in the future. The prospect of Medicare denials may dissuade an injured worker or their attorney from settling at all. Stakeholders in the industry must be cognizant of this risk and seek to prevent it from affecting their ability to resolve claims, which is where professional administration of Medicare Set Aside accounts can be beneficial.”

Importance of ‘The Marker’

One of the misconceptions that injured workers and their representatives may have is that Medicare is unaware of the specifics of the MSA throughout the settlement process and afterward. The reality is CMS tracks MSAs at certain key points.

At settlement, the Responsible Reporting Entity – the party responsible for funding a claim payment – must inform Medicare of the settlement and the amount – including the MSA. Post-settlement, the injured worker must send in annual attestations of their use of the MSA funds. If the amount used exceeds the MSA amount, the beneficiary must also send an ‘exhaustion attestation’ to receive additional reimbursement for medical treatment from Medicare.

At settlement, the Benefits Coordination & Recovery Center (BCRC), a Medicare contractor responsible for ensuring Medicare gets repaid for conditional payments, places a ‘marker’ on the injured worker’s file. “This is updated if the individual attests they have properly exhausted funds,” the study explains. “Until the BCRC receives proper attestation of the funds being exhausted, the Medicare administrative contractor (MAC) will deny any claims related to the injury.”

When a physician submits a bill to Medicare, the Medicare Administrative Contractor (MAC) reviews it to see if the marker on the person’s MSA account has been removed. If it has not, the claim will be denied.

Staying in Compliance

Failing to follow the rules that are laid out in the WCMSA Reference Guide can become a tremendous expense for injured workers. Not only must the MSA funds be used appropriately, but a variety of complex requirements must be adhered to for claims to be accepted.

The Medicare beneficiary or their representative may find it extremely difficult to stay in compliance with the requirements. While some injured workers choose to manage these accounts on their own, many find it overwhelming. In fact, CMS itself recognized this difficulty when in 2017, it “highly recommended that settlement recipients consider the use of a professional administrator for their funds.”

Professional administrators are focused solely on meeting the needs of the injured worker after settlement. Ideally, they get involved in the process pre-settlement to ensure those needs are properly addressed.

Professional administrators:

- Ensure funds are spent in accordance with CMS guidelines

- Protect an individual’s eligibility for future Medicare benefits by considering Medicare’s interests

- Ease the burden of compliance from the beneficiary

Changes during the last decade have made professional administrators an affordable option. Many employers and insurers pay the fee as part of the settlement agreement.

Summary

The volume of Medicare denials over the last few years emphasizes that it’s critical for employers, insurers, and representatives of these individuals to ensure injured workers have the necessary knowledge to be compliant with CMS’ MSA requirements after settlement.

Settling a workers’ compensation claim should start a new chapter for an injured worker – even when an MSA is included. This resolution can happen only if and when the account is set up and managed strictly according to the government’s rules and regulations. Properly informing injured workers settling with an MSA of their obligations to Medicare after settlement and turning to experts in the field, such as a professional administrator, are the best and most painless ways to prevent claim denials.