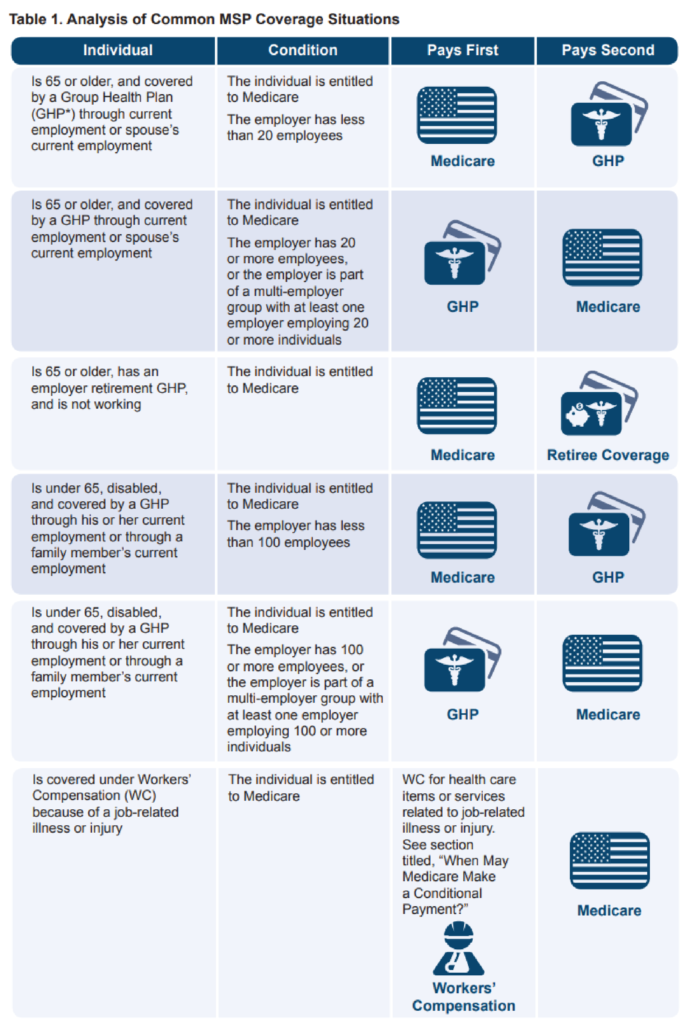

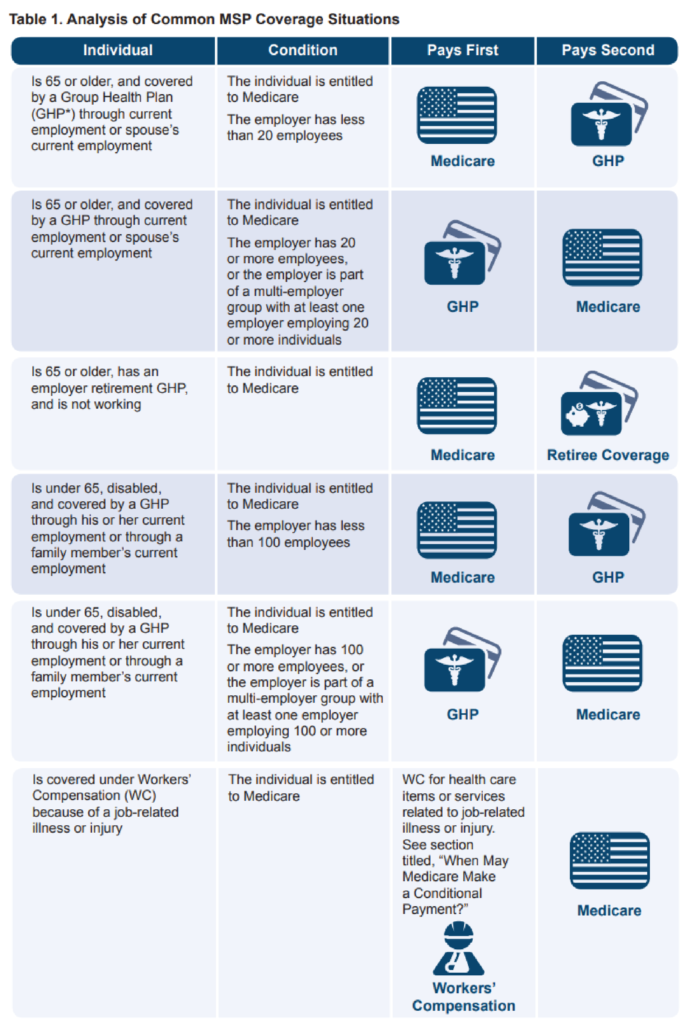

“Medicare Secondary Payer” (MSP) is the term used when Medicare is not the primary payer for medical care, meaning another group has the responsibility to pay before Medicare.

In this article:

Benefits aren’t available if another payer is primary under the MSP statute. If they are provided, it’s under the condition that they’ll be reimbursed if another payer accepts or is required to accept responsibility for them.

CMS requires Medicare Advantage and Part D plans to follow the same statutes, regulations, national coverage determinations and policy/process manuals published for traditional Medicare. CMS has also repeatedly stated that Part C and D plans must enforce MSP or risk a reduction in the payments that CMS provides for administration of Part C and D benefits, which has made those plans more vigilant in enforcing MSP.

Have questions about MSP?

Get In Touch With Our Team!

See

42 U.S.C. § 1395w-22 (a)(4)

42 U.S.C. §1395y(b)(2)

42 C.F.R. § 422.108(f))

Policy and Technical Changes to the MA and Part D Programs - Final Rule, 75 Fed. Reg. 19677 (April 15, 2010)

“Medicare Secondary Payment Subrogation Rights”, CMS Memo to MAPs and Part D Sponsors, Dec 5, 2011

The Medicare Managed Care Manual

The Medicare Prescription Drug Benefit Manuals

Benefits aren’t available if another payer is primary under the MSP statute. If they are provided, it’s under the condition that they’ll be reimbursed if another payer accepts or is required to accept responsibility for them.

CMS requires Medicare Advantage and Part D plans to follow the same statutes, regulations, national coverage determinations and policy/process manuals published for traditional Medicare. CMS has also repeatedly stated that Part C and D plans must enforce MSP or risk a reduction in the payments that CMS provides for administration of Part C and D benefits, which has made those plans more vigilant in enforcing MSP.

Have questions about MSP?

Get In Touch With Our Team!

See

42 U.S.C. § 1395w-22 (a)(4)

42 U.S.C. §1395y(b)(2)

42 C.F.R. § 422.108(f))

Policy and Technical Changes to the MA and Part D Programs - Final Rule, 75 Fed. Reg. 19677 (April 15, 2010)

“Medicare Secondary Payment Subrogation Rights”, CMS Memo to MAPs and Part D Sponsors, Dec 5, 2011

The Medicare Managed Care Manual

The Medicare Prescription Drug Benefit Manuals

- When is Medicare Secondary Payer applicable?

- Medicare Set Asides and MSP

- What is Medicare Secondary Payer Recovery?

When is Medicare Secondary Payer applicable?

Medicare Secondary Payer fact sheet

Medicare Set Asides and MSP

Additionally, MSP states that Medicare’s interests need to be taken into consideration during a settlement. This may be achieved by creating a Medicare Set Aside (MSA). A MSA is an allocation for future medical care over the injured party’s lifetime and projection of the medical costs needed. The Centers for Medicare and Medicaid Services (CMS) voluntarily reviews MSAs if two workload review thresholds are met:- Injured party is a Medicare beneficiary and the total settlement amount is greater than $25,000

- Injured party has a reasonable expectation of Medicare enrollment within 30 months of the settlement date and the anticipated total settlement amount s expected to be greater than $250,000

- The claimant has applied for Social Security Disability Benefits

- The claimant has been denied Social Security Disability Benefits but anticipates appealing that decision

- The claimant is in the process of appealing and/or re-filing for Social Security Disability benefits

- The claimant is 62 years and 6 months old

- The claimant has an End Stage Renal Disease (ESRD) condition but does not yet qualify for Medicare based upon ESRD

What is Medicare Secondary Payer Recovery?

MSP compliance also involves recovery of payments by Medicare. The MSP allows the Centers for Medicare and Medicaid Services (CMS) to make “conditional payments” for medical services received by an individual following an injury. With these conditional payments, Medicare is permitted recovery throughout the life of the claim or if there is a subsequent settlement.Medicare Advantage Plans (MAPs) and Prescription Drug Plans (PDPs)

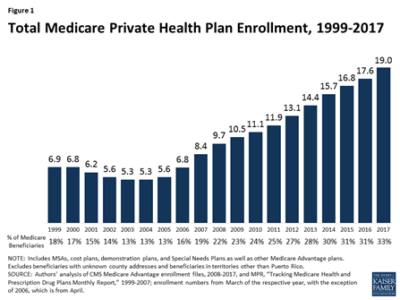

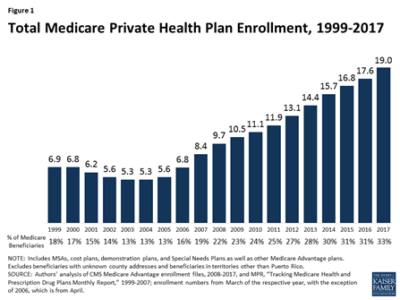

Medicare Advantage Plans (MAPs) and Prescription Drug Plans (PDPs) are additional insurance coverage options for Medicare-eligible beneficiaries. Medicare Advantage Plans have coverage offered by a private insurance company as a replacement for traditional Medicare Part A and B, whereas PDPs offer medication coverage through a private insurance company. These two types of plans have begun to see an increase in the right to recovery for payments made that were associated with an injured party’s claim both pre settlement with conditional payments and post settlement as it relates to MSAs. Whether they’re provided by traditional Medicare, Medicare Advantage or Part D, benefits are considered Medicare benefits under the MSP statute. In fact, 33% of people on Medicare actually have Medicare Advantage Plans. Benefits aren’t available if another payer is primary under the MSP statute. If they are provided, it’s under the condition that they’ll be reimbursed if another payer accepts or is required to accept responsibility for them.

CMS requires Medicare Advantage and Part D plans to follow the same statutes, regulations, national coverage determinations and policy/process manuals published for traditional Medicare. CMS has also repeatedly stated that Part C and D plans must enforce MSP or risk a reduction in the payments that CMS provides for administration of Part C and D benefits, which has made those plans more vigilant in enforcing MSP.

Have questions about MSP?

Get In Touch With Our Team!

See

42 U.S.C. § 1395w-22 (a)(4)

42 U.S.C. §1395y(b)(2)

42 C.F.R. § 422.108(f))

Policy and Technical Changes to the MA and Part D Programs - Final Rule, 75 Fed. Reg. 19677 (April 15, 2010)

“Medicare Secondary Payment Subrogation Rights”, CMS Memo to MAPs and Part D Sponsors, Dec 5, 2011

The Medicare Managed Care Manual

The Medicare Prescription Drug Benefit Manuals

Benefits aren’t available if another payer is primary under the MSP statute. If they are provided, it’s under the condition that they’ll be reimbursed if another payer accepts or is required to accept responsibility for them.

CMS requires Medicare Advantage and Part D plans to follow the same statutes, regulations, national coverage determinations and policy/process manuals published for traditional Medicare. CMS has also repeatedly stated that Part C and D plans must enforce MSP or risk a reduction in the payments that CMS provides for administration of Part C and D benefits, which has made those plans more vigilant in enforcing MSP.

Have questions about MSP?

Get In Touch With Our Team!

See

42 U.S.C. § 1395w-22 (a)(4)

42 U.S.C. §1395y(b)(2)

42 C.F.R. § 422.108(f))

Policy and Technical Changes to the MA and Part D Programs - Final Rule, 75 Fed. Reg. 19677 (April 15, 2010)

“Medicare Secondary Payment Subrogation Rights”, CMS Memo to MAPs and Part D Sponsors, Dec 5, 2011

The Medicare Managed Care Manual

The Medicare Prescription Drug Benefit Manuals