Professional Administration

Professional Administration is a third-party service that helps you manage your future medical funds after a settlement. When used for Medicare Set Aside (MSA) accounts it may also be called Medicare Set Aside Account Administration, though the service can help with any medical ongoing needs.

What is Professional Administration?

Professional administration services provide access to discounted drug, provider, and medical equipment pricing, technology that provides a hassle-free experience with medical care, and a dedicated team of representatives to answer questions and help you navigate your medical care. The service also protects the injured person’s Medicare benefits in the case of a Medicare Set Aside (MSA).

Savings on Treatment

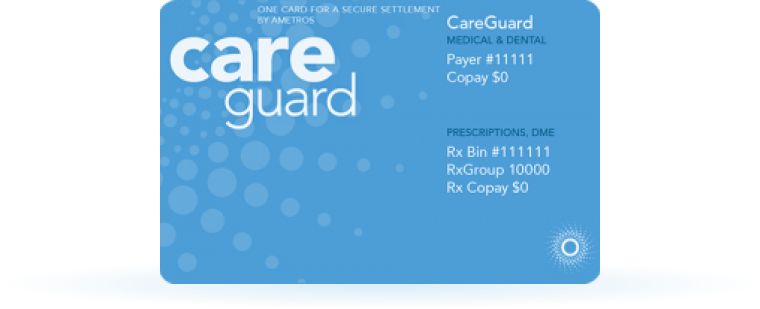

A professional administrator establishes a dedicated bank account for your medical settlement funds related to your injury. Most administrators provide you with a card that works like a health insurance card. When you show the card at your pharmacy or doctor, the administrator receives the bill, applies discounts, and then pays the bill automatically. You never have to touch a bill, but receive a record of every transaction, the savings and your account balance information.

Reporting & Medicare Compliance

Don’t deal with the hassle of paperwork! A professional administrator automatically files necessary reporting for Medicare Set Aside (MSA) accounts, protecting your future Medicare benefits. If reporting is not done properly, Medicare benefits can be jeopardized. The service can be used for any medical allocation (MSA or non-MSA medical funds) as the many benefits of the service extend beyond Medicare Set Aside reporting.

Resources & Support

A professional administrator has representatives available to speak with you about your journey to wellness. Many are staffed with pharmacists and other medical experts that can provide information and discuss options with you. Additionally, professional administrators usually have available durable medical equipment (DME) experts who can help the injured individual access any needed equipment—all at reduced prices.

Freedom

Each workers’ compensation or liability case has its own unique variables, so there is no one size fits all used to calculate your claim's future value. It’s important to understand what future medical treatment you will need going forward so that you can ensure the settlement funds are adequate to cover future medical care.

Is Professional Administration Required?

Medicare “highly recommend[s] that settlement recipients consider the use of a professional administrator for their funds.”

See Workers' Compensation Medicare Set Aside Reference Guide, v.4.0, Sec. 17.1.While current guidelines from Medicare allow for you to self-administer a Medicare Set Aside, due to the complexities and risk involved, it is clear why Medicare highly recommends the use of a professional administrator.

If the Medicare Set Aside is improperly managed or administered, it could adversely affect your Medicare benefits and severely interrupt and complicate ongoing treatment, as Medicare could refuse to pay for treatments until you can show you used the Medicare Set Aside funds appropriately.

Medicare requires that all Medicare Set Asides be administered following these five main guidelines:

- The funds must be held in an interest-bearing account

- The funds may only be used for treatments related to the injury

- The funds may only be used for Medicare-covered expenses

- The funds must be paid according to the appropriate fee schedule

- The injured individual must prepare and submit an annual accounting report to Medicare

- The injured individual must maintain line item detail for the duration of eligibility

If you do not comply with this complex list of requirements, you risk being denied your benefits by Medicare.

When to Involve a Professional Administrator

How to Choose a Professional Administrator

Not all administrators are created equal. One single factor should not drive the overall decision on which professional administration company to utilize. The service, tools, and professionalism along with savings provided by the administrator on behalf of the injured party can vary drastically. For more information about choosing a professional administrator please read our blog article - The 7 Factors to Consider When Choosing a Professional Administrator.

When deciding which professional administrator to go with, there are many factors that should be taken into consideration

CareGuard was created with one goal in mind: making the post-settlement process seamless. We do this through our combination of member support and professional administration services.

CareGuard is the first fully automated solution for professional administration which gives the member insight into their spending and savings trends. Our team is experienced working with settlements that are both structured into annuities or paid out in a lump sum. We also manage funds for both Medicare Set Asides and other medical allocations.

-

Extending Medicare Set Aside Funds: Ametros discounts can save you up to 60% on provider bills and 38% on all other medical expenses, allowing your medical funds to last as long as possible.*

-

Freedom to Treat: Members can see any doctor or provider, without Utilization Review.

-

Support: access to our team of Care Advocates.

-

Technology: A state-of-the-art online portal where members can review the status and total savings of their CareGuard Medicare Set Aside Account.

-

Reporting: With CareGuard, all reporting is handled and members are compliant with Medicare guidelines.

|

Self-Administration

Without Ametros |

Self-Administration Tool

|

Professional Administration

|

|

|---|---|---|---|

| Bank Account | Funds are held in your personal bank account | Connects to your own personal bank account | Ametros establishes separate bank account in your name per Medicare guidelines |

| Savings | You may pay full price for medications and treatments | An average annual savings of 21% on all medical expenses* | Ametros discounts can save you up to 60% on provider bills and 38% on all other medical expenses.* |

| Record Keeping | All medical receipts must be filed and stored by you | Purchases made are automatically recorded in the online portal, or can be recorded by you in the portal | Purchases made with the CareGuard card are automatically recorded in the online portal |

| Reporting | Reports need to be completed according to Medicare guidelines in order to protect your benefits | Expense reports can be downloaded or sent to Medicare in one click | Worry free, fully managed automatic reporting |

| Support | Support consultations available | Dedicated support team to answer questions as they arise | |

| Telehealth | Access to Telehealth from the portal | ||

| Mobile App | CareGuard mobile app for easy access to your card information and expenses wherever you are | ||

| Get Our Free Starter Packet! | Sign Up Now | Contact Us |

|

Self Administration

Without Ametros |

|---|

Bank AccountFunds are held in your personal bank account |

SavingsYou pay full price for medications and treatments |

Record KeepingAll medical receipts must be filed and stored by you |

ReportingReports need to be completed according to CMS guidelines |

Support |

Telehealth |

Mobile App |

| Get Our Free Starter Packet! |

|

Self-Administration Tool

|

|---|

Bank AccountAmethyst connects to your personal debit account |

SavingsAn average annual savings of 21% on all medical expenses |

Record KeepingPurchases made with the Amethyst Card are automatically recorded in the online portal |

ReportingExpense reports can be downloaded or sent to Medicare in one click |

SupportSupport consultations available |

Telehealth |

Mobile App |

| Sign Up Now |

|

Professional Administration

|

|---|

Bank AccountAmetros establishes a separate bank account in your name per CMS guidelines |

SavingsOn average, members save 62% on provider bills, and 28% on all other medical expenses |

Record KeepingPurchases made with the CareGuard card are automatically recorded in the online portal |

ReportingWorry free, fully managed automatic reporting |

SupportDedicated support team to answer questions as they arise |

TelehealthAccess to Telehealth from the portal |

Mobile AppCareGuard mobile app for easy access to your card information and expenses wherever you are |

| Contact Us |