One of the biggest reasons injured individuals are reluctant to settle their claims is uncertainty. It often keeps many individuals involved in the workers’ compensation system for years, preventing the person from moving on with their lives and turning these injuries into legacy claims that stay on payers’ books unnecessarily. Fortunately, there are solutions available to assist injured individuals in navigating these uncertainties and to support insurance professionals in achieving efficient and successful medical settlements. Dive deeper to discover how professional administration protects medical funds and resolves uncertainties during the settlement process.

Table of Contents

Among the most pervasive uncertainties are:

- Running out of funds too soon.

- Inability to meet the strict compliance requirements of Medicare, including tasks like annual attestations and exhaustion letters.

- Losing federal and/or state benefits.

- Navigating the healthcare system on their own – especially if they have complex medical issues.

Working with an experienced, capable professional administrator will ensure a secure and simplified settlement – which is key to resolving these claims.

The federal government recommends using professional administrators to help settle medical cases and provide lifetime support to affected individuals. The most qualified work closely with injured individuals, insurers, employers, attorneys, medical professionals, and others to simplify and create a smooth transfer of healthcare. Those with the highest degree of knowledge and experience are in the best position to help manage these settlements with professional administration.

Money

Problem

Navigating a workers' compensation or liability case resolution can be intricate, especially when the prospect of an injured individual depleting their medical settlement funds creates a significant barrier to case closure. Before settling, individuals must consider a range of costs beyond immediate medical expenses.

Within this complex landscape, uncertainty prevails as a significant theme. Individuals dealing with injuries may find themselves in the dark about the substantial financial cushion required for a lifetime of security.

Solution

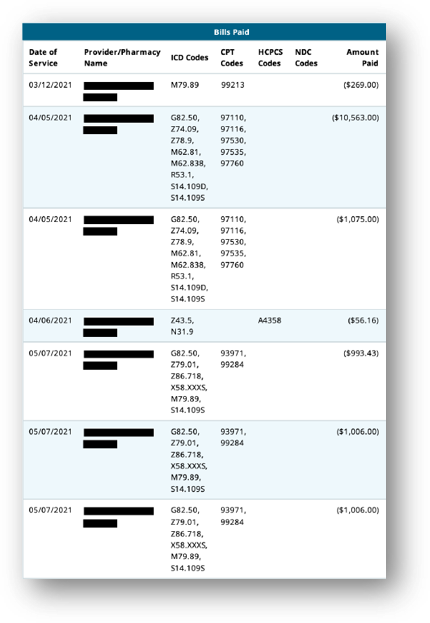

In the realm of post-settlement financial management, professional administrators play a pivotal role in ensuring funds are maximized. Their expertise can facilitate the extension of funds by securing potential discounts through their provider and pharmacy network and negotiating with service providers. A professional administrator has the expertise to ensure that funds are billed with the correct ICD-9 and 10 codes and according to the appropriate fee schedule. They can also negotiate fees, when necessary, ultimately maximizing an individual's medical funds for an extended period.

Early involvement of a professional administrator becomes crucial, providing valuable insight into identifying future expenses that may require coverage through a non-Medicare covered medical account allocation. A professional administrator can administer non-Medicare allocations and assist with non-Medicare covered services, such as home health care.

These funds may be referred to as ‘non-qualified’ medical expense accounts, or ‘medical custodial accounts.’ This proactive approach not only enhances financial efficiency but also contributes to long-term security for individuals navigating the aftermath of settlement.

Beyond the medical expenses, professional administrators work closely with the injured individual and their family to alleviate the stress of having to coordinate long-term medical needs, such as Durable Medical Equipment (DME), prosthetics, and long-term home health care.

Medicare Compliance

Problem

In the case of a Medicare Set Aside (MSA), the injured individual’s future Medicare benefits related to their injury may be on the line if they are not compliant with government requirements. This affects an injured individual who is, or soon will be eligible for Medicare. Many individuals opt to establish an MSA account to demonstrate that Medicare is not paying expenses that are the responsibility of the injured individual via the settlement.

A MSA is a portion of the overall settlement that is set aside to cover all future medical expenses related to the specific injury and otherwise covered by Medicare. If The Centers for Medicare & Medicaid Services (CMS) has approved the MSA account and if the account has been properly depleted, Medicare will step in as the primary payor – if all reporting and compliance requirements are met.

Ensuring adherence to Medicare’s rules is complex and quite daunting to anyone except those extensively trained to do so. Among the requirements are:

- Reporting annually to Medicare any and all medical expenses related to the injury

- Utilizing the funds exclusively for expenses related to the injury, and in the context of an MSA, limiting use to Medicare-approved items

- Maintaining the money in an interest-bearing account

- Maintaining line-item detail for the duration of the injured individual’s lifetime

If any of these conditions are not met, Medicare may deny payment for treatments. Once that happens, the injured party must replenish the MSA account for the costs that were unaccounted for.

Solution

Professional administrators provide peace of mind to injured individuals and those working with them by ensuring Medicare’s guidelines are followed appropriately.

Professional Administrators:

- Ensure that the MSA allocation is administered based upon the settlement agreement

- Ensure government guidelines are followed, thereby protecting the injured party’s future Medicare coverage related to the injury

For example, professional administrators

- Submit detailed annual attestation reports to demonstrate that the individual is spending his funds only on injury-related, Medicare covered expenses

- Provide the government with reports to show if the individual runs out of funds to cover his injury related expenses, either temporarily or permanently; thereby paving the way for Medicare to step in

- In the case of annuity with temporary exhaustion, Medicare steps in as primary payer and once the annual annuity is funded the administrator would step back in

Government Benefits

Problem

Government benefits may be put at risk by a settlement. Medicaid, Supplemental Security Income and short- or long-term disability are among them.

Solution

Professional administrators work with experts who can set up various trusts to protect other government benefits. These trusts ensure needs-based or means-tested benefits will continue.

There are a variety of trusts, such as:

- Special Needs Trusts

- Settlement Protection Trusts

- Settlement Management Trusts

- Trigger Trusts

- Minors Trusts

These trusts serve different purposes and are invaluable when needed and done properly. It’s imperative that such trusts be established prior to settlement. Professional administrators work with trustees throughout the country to administer future medical funds held within any trust account. Included may be funds needed for prescriptions, doctor visits, or durable medical. Best in-class professional administrators have a dedicated team to focus on these types of account needs and are able to work with all settlement parties involved to help coordinate setting up these accounts.

Comfort and Advice

Problem

The idea of having to navigate the complicated healthcare system leaves many injured individuals feeling alone and scared. Reaching a settlement agreement means the end of important relationships for injured individuals. Nurse case managers, claims professionals, attorneys and others involved are no longer a part of the injured party’s life and medical decision making.

Solution

Professional administrators serve injured individuals. They work with the individual for life, addressing whatever needs and questions may arise. While professional administrators are often very involved in the pre-settlement process, their real expertise comes in after the settlement.

The most highly rated professional administrators take their role to heart, working closely with injured individuals to help them:

- Weigh various medical options and alternatives

- Understand any recommended treatments, procedures, or medications

- Find the most cost-effective medical care

The last thing an injured individual wants is to feel abandoned after settling their claim. Professional administrators provide lifetime support to the individual.

Professional Administration

The complexities of managing settlements for injured individuals is such that the CMS wrote: “It is highly recommended that settlement recipients consider the use of a professional administrator for their funds.” The statement, issued several years ago, underscores the need to ensure all aspects of settlements are properly handled. Settlement specialists who are experts in their field bring the security needed to allay the injured workers’ fears that their money will last and that they will be in full compliance with government requirements.

Complying with Medicare’s requirements is crucial to ensure no money is misspent. Professional administrators have experts to oversee and manage all reporting requirements, thus ensuring Medicare’s interests are fully considered.

For professionals working with injured individuals, a professional administrator offers peace of mind and case finality.

Claims managers, attorneys, physicians, and others involved want to know that Medicare’s requirements will be securely handled.

Working with a top-notch professional administrator ensures the security of the settlement – in terms of both the funds and the compliance issues. It provides assurance that the injured individual will be able to survive and thrive after the settlement.

Conclusion

Miriam Webster defines ‘security’ as “the quality or state of being secure,” including “freedom from fear or anxiety.” The lack of security is a fear that prevents many injured individuals from settling their medical cases. Using a professional administrator can alleviate that uncertainty and lead to optimal claim closures. If you have questions about how Ametros can protect your medical settlement case with professional administration, please feel free to contact our team.