Navigating Medicare Set Asides (MSAs) post-settlement can be daunting, particularly for those dealing with injuries. Often overlooked, attestation reporting to the Centers for Medicare & Medicaid Services (CMS) is a critical obligation. Neglecting it may jeopardize future Medicare benefits tied to the injury. Discover why attestation reporting is vital and how a professional administrator offers a comprehensive solution for peace of mind in MSA management.

The Link Between Reporting and Future Medicare Benefits

The video above sheds light on the intricate process of MSAs and underscores the significance of attestation reporting. Attestation reporting involves providing documentation to CMS, confirming that the allocated MSA funds are used appropriately and in compliance with Medicare guidelines. This reporting is a proactive measure to safeguard future Medicare benefits related to the work injury.

Why is this so crucial? Failure to adhere to attestation reporting requirements can result in the denial of future Medicare coverage for services related to the specific injury. This could leave individuals facing unexpected medical expenses and jeopardize their long-term well-being in the future.

Understanding Medicare Secondary Payer (MSP)

Mastering the intricacies of Medicare Secondary Payer (MSP) regulations is pivotal for both injured workers to adhere to post-settlement. Successfully settling a workers' compensation case is a major achievement, but the significance of the journey persists, particularly with the involvement of MSAs. MSP regulations are in place to uphold Medicare as the secondary payer for medical expenses tied to a workers' compensation injury.

It is imperative for injured workers to grasp that the proper use of their MSA funds after settlement is paramount. This ensures that Medicare retains its role as the secondary payer, a critical consideration now that the employer or insurance carrier is no longer the primary payer. Non-compliance brings consequences, emphasizing the necessity of addressing these challenges with a clear understanding and proactive solutions, such as professional administration of an MSA. To steer clear of financial pitfalls and ensure future medical care, navigating the post-settlement landscape requires a vigilant approach to compliance and a commitment to safeguarding the continuity of Medicare benefits. Fortunately, there are fail-safe solutions and resources available to ensure MSAs are managed properly and effectively support an injured worker’s care. Before delving into these solutions, let's first examine several compelling reasons to prioritize MSA compliance after settlement.

Reasons to Prioritize Compliance

Financial Implications: Failure to comply with Medicare Secondary Payer (MSP) regulations carries substantial financial risks for injured workers. Non-compliance puts individuals at risk of losing future access to Medicare benefits, potentially resulting in unforeseen out-of-pocket expenses if medical costs tied to the workers' compensation injury are denied due to non-compliance.

Future Care Implications: If proper annual reporting and compliance measures are not met, the Centers for Medicare & Medicaid Services (CMS) holds the authority to deny Medicare benefits for services linked to the injury. Given that future care may be necessary at any time, particularly for catastrophic or long-term injuries, Medicare denials can profoundly affect an individual's access to essential future medical care. This underscores the critical importance of meeting all reporting requirements to ensure continuous access to Medicare benefits when needed.

Resource Dilemma: Following a settlement, injured workers frequently find themselves navigating the complexities of their unique Medicare Set Aside without clear guidance. The trusted resources they once relied on, such as their attorney or nurse case manager, are no longer accessible for ongoing support, leaving them without a lifeline when questions or concerns about the settlement arise. Recognizing the importance of having adequate resources in place before settling is crucial to safeguarding the interests of injured workers in the post-settlement phase. Notably, having the necessary resources for completing attestation reporting emerges as a pivotal factor for ensuring success and peace of mind after settlement.

Professional Administration as a Post-Settlement Solution

Recognizing the challenges faced by individuals in navigating the MSA landscape, Ametros’ professional administration service, CareGuard, emerges as a comprehensive solution. CareGuard specializes in professional administration of any future medical allocation, especially MSAs, providing a secure and compliant framework to manage funds post-settlement.

CareGuard acts as a trusted partner for injured workers, ensuring compliance with attestation reporting to protect their future Medicare benefits. By leveraging CareGuard’s expertise, individuals can navigate the complexities of MSAs with confidence, avoiding pitfalls that may arise from non-compliance.

Attestation Reporting Unraveled for Injured Workers

Injured workers often find themselves grappling with complexities of MSA attestation reporting that vary depending on the type of medical funding option they settled with. When a professional administrator steps in, it ensures peace of mind by seamlessly managing the intricacies of these reports. The following reports are the type of attestation reports a professional administrator completes on behalf of the injured worker so they can focus on their care.

Annual Accounting Reporting

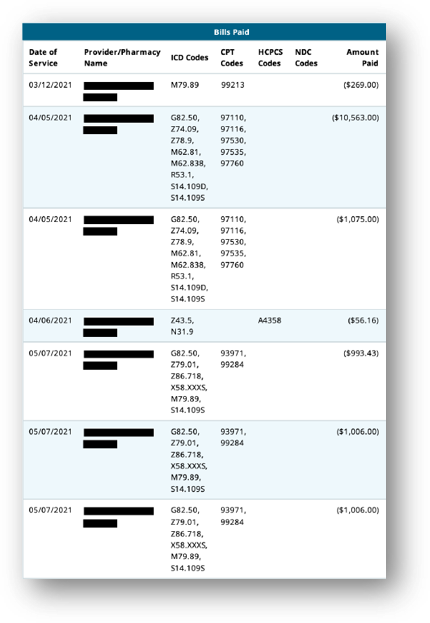

Think of this as an injured worker having a personal tax expert for their MSA. A dedicated team meticulously tracks every expense and code, creating a comprehensive report that serves as a transparent record. This meticulous approach ensures that Medicare gains a clear perspective on how the injured workers have allocated their funds and is the most important report to protect an individual’s future Medicare benefits.

Temporary Depletion Report

For those with structured settlements facing a temporary depletion of funds for an approved MSA for the year or payment period, an administrator files this report to let Medicare know to step in to pay and cover their injury-related treatments until their next annuity check arrives. This reporting ensures a seamless transition, providing continuity of care for injured workers, even during temporary depletion of funds.

Permanent Depletion Report

If individuals permanently run out of funds for an approved MSA, we file a report with Medicare to show they spent all their funds appropriately. This alerts Medicare to start paying for injury-related treatment. Should the MSA funds be permanently exhausted, a comprehensive report is filed with Medicare, showcasing that every dollar was appropriately spent. This not only marks the conclusion of the MSA funds but also serves as a signal to Medicare to commence covering injury-related treatments. It's a definitive move toward securing the ongoing support injured workers need, even as their MSA journey reaches its conclusion.

A professional administration service like CareGuard takes the complexity out of an injured worker’s hands, providing a clear and expertly managed pathway tailored to their unique needs. Beyond ensuring adherence to reporting regulatory requirements, CareGuard leverages its extensive provider and pharmacy network to offer potential discounts on medical expenses related to a workers’ compensation or personal injury. This proactive approach not only stretches medical settlement funds but also ensures that individuals have resources available for future medical needs. With CareGuard, it's not just about compliance; it's about securing a future where healthcare remains accessible and uncompromised.

Conclusion

MSA attestation reporting is not just a bureaucratic requirement—it's a lifeline securing future Medicare benefits for individuals overcoming injuries. Choosing Ametros as your professional administrator means more than just ensuring compliance; it means accessing a wealth of expertise. Ametros offers a robust post-settlement solution for protecting future medical care, ensuring compliance while providing injured workers with the confidence that comes from trusting experts. It's about securing MSAs and, more importantly, safeguarding the well-being of individuals who rightfully deserve peace of mind post-settlement.