Our members commonly ask, “what can I spend my MSA funds on?” or “is this item covered in my MSA?” These are important questions, as Medicare has a specific list of the approved medications, treatments and equipment that they cover. The treatments you pay for with your Medicare Set Aside funds must be Medicare-approved. In addition, the treatments you get must also be related to your injury.

For background, when a medical case is settled, and involves a MSA, Medicare is notified. Medicare established this reporting process to protect their interests in the event of an individual running out of their medical funds and then turning to Medicare for support.

Medicare has a required set of guidelines for injured parties who have settled. These guidelines can restrict what treatments, prescriptions, and durable medical equipment (DME) can be paid for with your MSA funds.

There is a danger in self-administering your own MSA. If you run out of funds, Medicare could reject you if you did not follow the proper way to report purchases made with your MSA funds. This means you may be denied Medicare coverage and could be in real trouble. MSA professional administration is important because it guarantees that individuals protect their Medicare benefits, staying in compliance with MSA guidelines.

At Ametros, we provide Medicare Set Aside account administration and assistance for thousands of injured individuals. We will advocate for our members to ensure they are happy and taken care of after they settle. We ensure that our members have access to the treatments they need by:

Providing outreach to doctors and providers to determine medical relatedness

When Medicare determines if a treatment was a valid use of your MSA funds, they ensure it was related to your initial injury. Our team will contact your doctor to obtain documentation describing why treatments were prescribed, including letters of medical relatedness.

These letters explain that a treatment is necessary because of your initial injury. This can be the difference between if your treatment is recognized as valid down the road if you ever are questioned.

We often see our members request items that require documentation, because if they were taken out of context they may not be obviously related to the injury. For example, if you sustained a neck injury, and now need a therapeutic pillow to reduce your pain, your doctor should write a note confirming you need this pillow because of the initial neck injury. With that note on file, you are covered if questions arise over why you used the MSA funds for that purchase.

You can only spend your MSA funds on treatments related to your injury. This means it is necessary to keep documentation that proves you are spending the funds properly. CareGuard does all of this for you so you don’t have to worry about it.

Ensuring the proper codes are used when submitting a claim

Medicare has a specific list of the treatments, prescriptions and durable medical equipment that they cover. Each item has a code, known as the CPT, NDC or HCPCS code. When filing a claim, your treatments and codes must be on this approved list. Otherwise your purchase with your MSA funds may not be recognized as valid by Medicare.

For example, many times hydrotherapy may be necessary to see improvement in your injury. However, if you do not show the proper HCPCS coding, Medicare may question your purchase. Our team ensures that items like hydrotherapy are reported under the correct codes, making sure you get the treatment you need while also protecting your Medicare benefits.

For example, many times hydrotherapy may be necessary to see improvement in your injury. However, if you do not show the proper HCPCS coding, Medicare may question your purchase. Our team ensures that items like hydrotherapy are reported under the correct codes, making sure you get the treatment you need while also protecting your Medicare benefits.

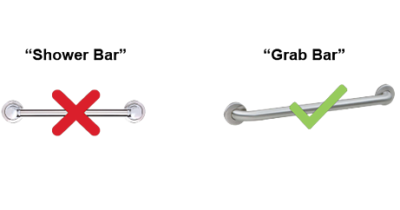

Another example of an item that causes a lot of difficulty with MSA funds is purchasing a shower bar. Many of our members request shower bars to help them with mobility in and out of the bathtub or shower. A quick search on Medicare’s website would reveal that Medicare does not approve shower bars, so many folks with MSA’s assume they cannot use their MSA funds to buy one. Instead, our team will purchase a “grab bar,” HCPCS code E0910, that serves the same function and is Medicare-covered. This alternate is a valid use of the MSA funds.

We will advocate for you

Our team will do everything possible to ensure that you can treat the way you would like to after settlement. As part of Ametros’ Medicare Set Aside account administration services, you will not have to undergo utilization review, independent medical examinations or qualified medical evaluations and have your treatments denied.

We treat your MSA as a guide, and understand that the details of your MSA might not fully cover the spectrum of care you require. So, we are always striving to go above and beyond to make different treatments and medications available to our members. If it is related to your initial injury and Medicare-covered, you can get medical care you deserve.

If you have any questions about your Medicare Set Aside or our reporting capabilities, please give us a call. For members, Ametros’ CareGuard and Amethyst services provide you with 24/7 access to our team.

To find out more about how we can help you administer your Medicare Set Aside, call us at 877.275.7415 or email us at referral@ametros.com.