A central challenge to closing open medical claims is the lack of transparency into the future cost of healthcare. Adjusters, attorneys and injured individuals have lacked a reliable source when predicting how much future treatments will cost. Variability in the estimates of healthcare costs can make settlements hard to reach. All parties at the settlement table deserve to work with a company that will provide true, transparent quotes on the pricing that the injured individual will actually pay after they settle. This information facilitates a more productive negotiation and provides reassurance to the injured individual that their needs will be met.

At Ametros, our CareQuote service provides that information; it allows parties to go into their negotiations well-grounded with the knowledge of what settlement amount is acceptable for future medical care.

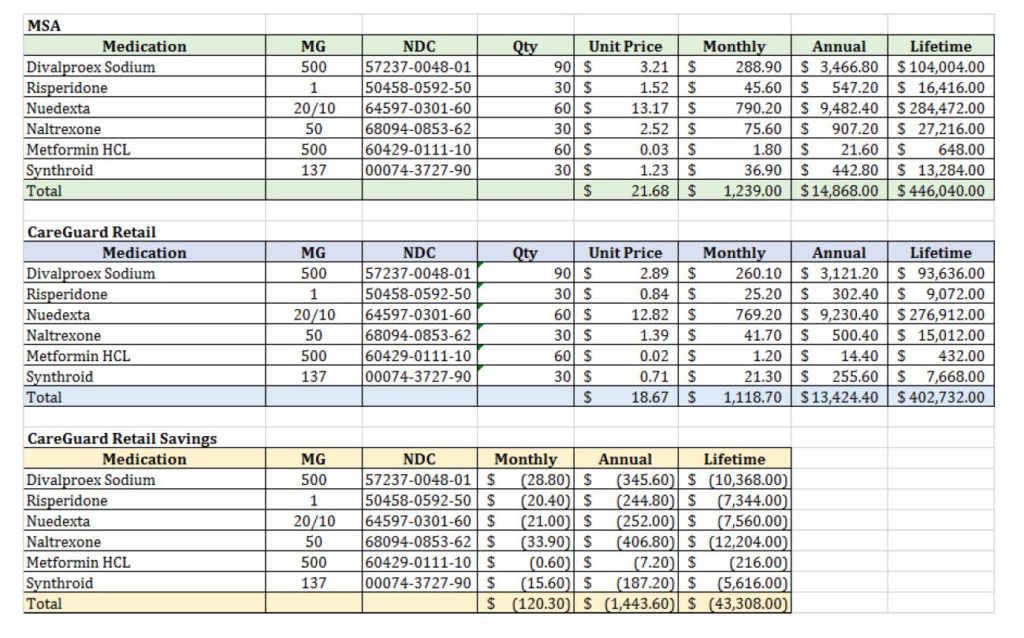

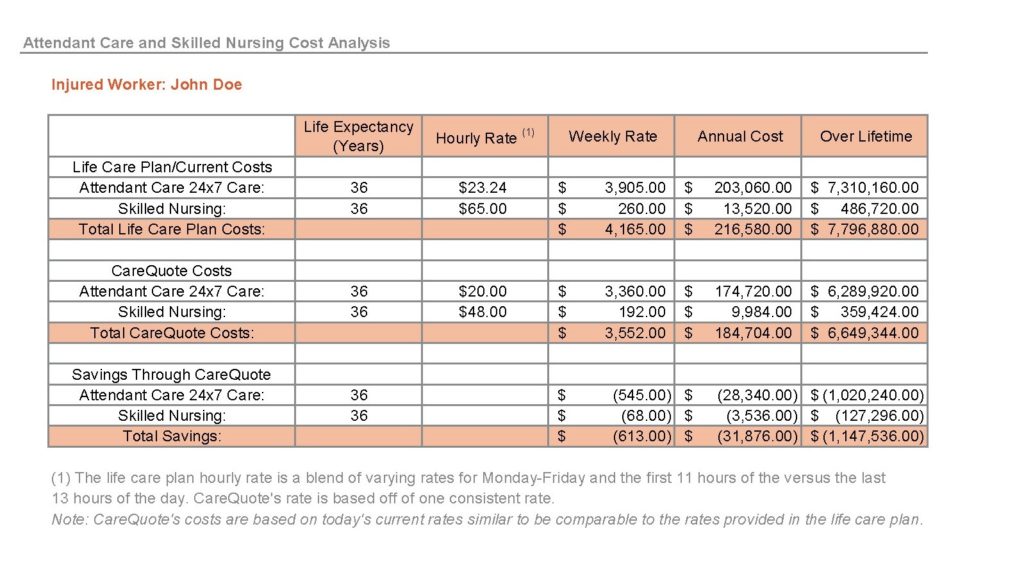

Ametros’ new CareQuote service shows a precise look at the actual price the injured individual will pay after they settle and become a member on the Ametros platform. At Ametros, thousands of injured individuals, our members, are using our networks to make healthcare purchases with their Medicare Set Aside (MSA) accounts or with the cash allocated for their other medical care (non-MSA monies). In order to save our members money, we at Ametros have established group purchasing networks that provide discounts on doctor visits, drug purchases and equipment purchases. On average, Ametros’ administration services provide pricing that is 30-40% below the pricing in most MSA projections or life care plans.

For example, a recent CareQuote Ametros constructed showed that with Ametros’ discounted pricing, it was possible to provide the level of care that a life care plan estimated to be $7.7 million on a liability case for just $6.6 million. The structured broker handling the case presented the CareQuote (below) at the negotiation. By showing Ametros’ discounted price, he showed there was negotiating room for the parties to reach a compromise. The parties split the difference on the savings, ultimately settling for $7.15 million. The result was the injured individual and their attorney were confident there were enough funds and the carrier was able to settle at an approved authority level. It was a creative approach to bridging the gap between the defense and plaintiff side and creating an end result that helped both sides reach an acceptable settlement.

CareQuote is a unique service because Ametros shares the true pricing of its discounted networks that are available post-settlement. If the case settles and the individual elects to use CareGuard, the injured individual knows that the prices provided are the true price that CareGuard’s current members are receiving via its platform for the exact drugs, equipment and treatments needed. That is a far cry from the vague ranges most life care plans provide – ranges for services and items that are quoted from random sources and that no one is even sure the injured individual will be able to secure. In many situations, CareQuote should be used in conjunction with life care plans and other medical projection reports (MSA or non-MSA). While the life care plan and medical reports provide the treatment required, CareQuote can be utilized to provide more transparency into the cost of the treatment.

With CareQuote, if the injured individual joins CareGuard, they will have access to the exact vendors that were in the quote so they can rest assured that the pricing is accurate. Currently, CareQuote is accessible by contacting our team at carequote@ametros.com. However in early 2017, many more advanced tools and features including an online portal will be released. Give CareQuote a try today for free to see what the medical care you are negotiating would actually cost on the CareGuard platform.

For more information on CareQuote or CareGuard, call 877-275-7415, or email us at carequote@ametros.com.