CareQuote provides quick quotes for prescriptions, home healthcare, skilled facility care, and durable medical equipment services. Often times, it is hard to guess what the cost of medical items will be for an individual after they settle their case. With CareQuote, we provide injured parties insight into the actual pricing of these items on our discounted networks after settlement. CareQuote can be used in all personal injury cases, including workers’ compensation and liability cases, in order to bridge the gap to settlement for both the defense and plaintiff.

Effective tool for mediators!

Our CareQuotes show post-settlement savings on our platform versus self-pay rates. When injured parties become uninsured patients after settlement, they typically have no help to navigate the system and no access to discounts. This is where we are able to drive significant savings with our network providers.

;)

We Can Quote:

Prescriptions

- The national Drug Codes, or NDC

- A list of the medications the injured party is taking

- Any recent MSA's and Care Plans (within the last year)

Facility Care

- The current facility and that we have approval to use the injured party's name when speaking with the facility

- Are we looking for a new facility? We will quote a low, medium, and high facility cost

- What level of care does the injured party require? An MSA or future medical report will give this information

- Is the injured party willing to change facilities?

Home Healthcare

- How many hours per day, per week, and what type of care is required (home health aid, LPN, RN, etc.)

- Is care currently done by a particular agency?

- Is the injured party willing to change agencies?

Durable Medical Equipment

- Exactly what the injured party is using - MSAs usually quote a generic DME, for example with wheelchairs, we need to know the height and weight of a claimant

- Exactly what the injured party is receiving - typically an adjuster will be able to run this report

- For prosthetics, we need specifics - most of the time the adjuster will have the most recent invoice for a particular prosthetic

CareQuote Turnaround Times

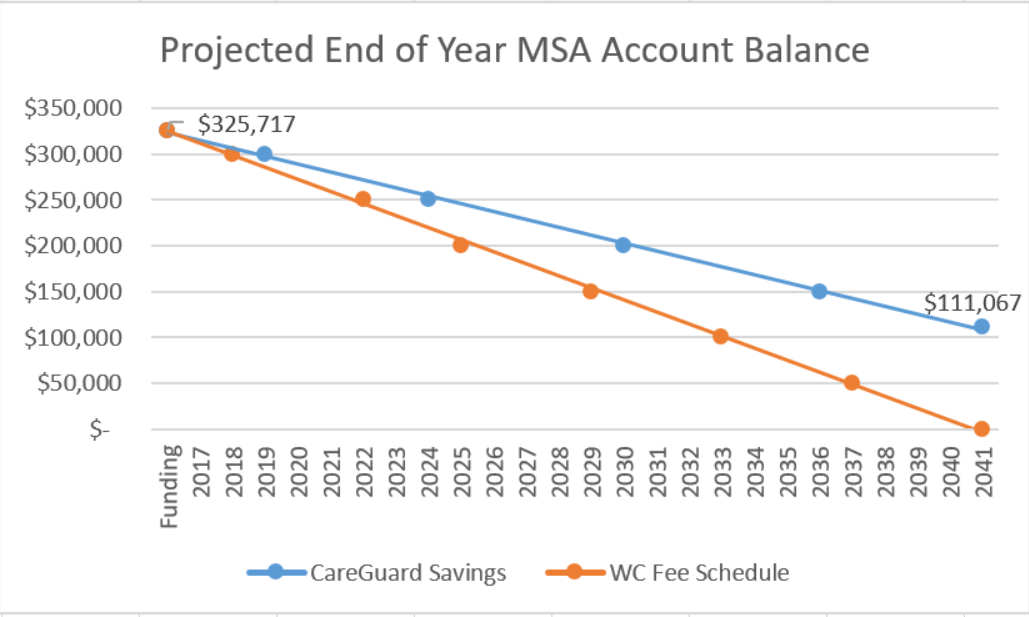

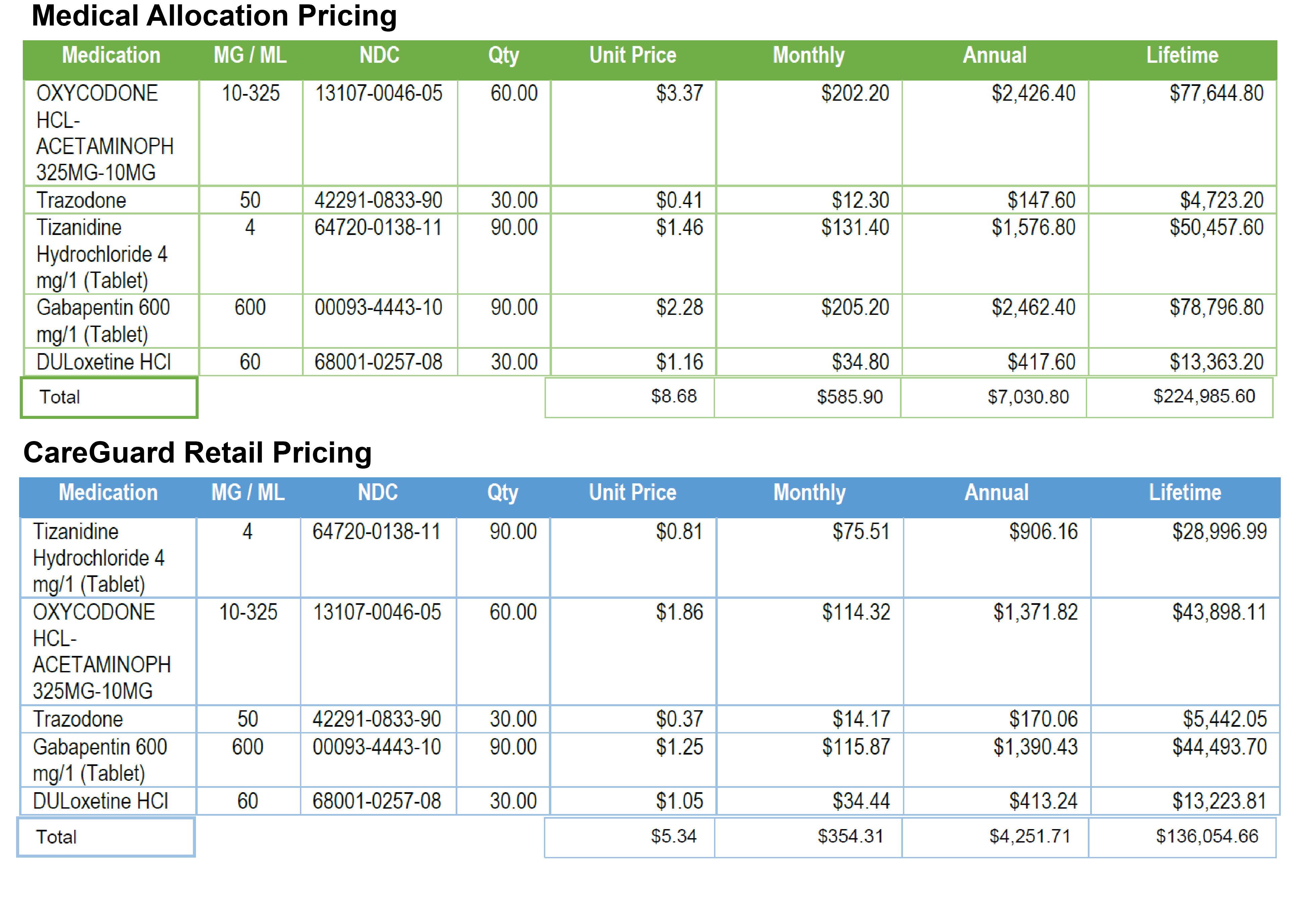

We can provide quotes in 2 days or less for prescriptions, 2 weeks or less for facility care and home healthcare, and 1 week or less for durable medical equipment. CareQuote is most often used to help settle cases. These quotes are not used to determine the allocation amount. Our quotes assist in making the injured party feel more comfortable with the amount being allocated, giving them the confidence to settle their case.

Sample CareQuote

;)

Request a CareQuote

*Disclaimer: Any potential discounts or savings for medical treatment, including but not limited to, prescription drugs, durable medical equipment and/or healthcare items and services, are not guaranteed. Ametros has made no warranties, promises, representations or guarantees whatsoever about potential cost savings or the level of potential discounts obtained on any item, service or prescription payment. There are no assurances that prior successes or past results as to cost savings will be applicable to a Member on any of Ametros’ platforms. For additional information, please see our Terms & Conditions Page.