Get in Touch with Ametros

Your Settlement Experts

At Ametros, we make it easy for you to get the support you need. Whether you need assistance managing a medical fund, have questions about a settlement, or are looking for expert support for your clients, our team is ready to help. Fill out the form below, call us, or email us, we're here to help you every step of the way.

Contact Us

Your Local Ametros Representative

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- DC

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

What Our Members & Partners Are Saying

I now have a life because of Ametros, and I can't thank them enough.

CareGuard Member

Watch the video!

Everyone is so caring when speaking with me that I wish all companies ran like CareGuard. Exceptional service and staff. I rate you guys at a 10. Thanks for caring

CareGuard Member

Everyone that I have dealt with at CareGuard has been friendly and extremely helpful.

CareGuard Member

Need more information?

Explore some of our most popular resources below.

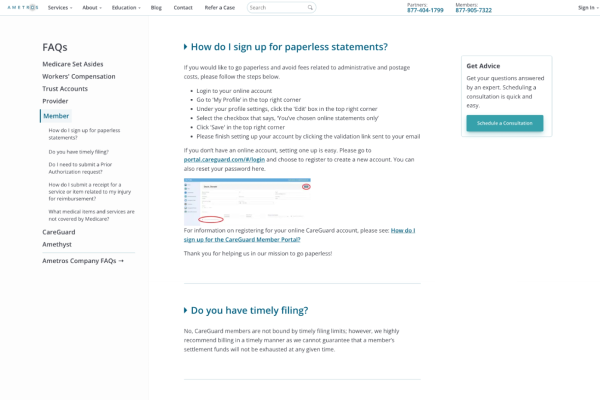

Member Frequently Asked Questions

Have a question about your CareGuard membership? Check out our Frequently

Asked Questions.

Provider Frequently Asked Questions

Read our collection of frequently asked questions for healthcare

providers.

Refer a Case

If you are looking to refer a case to us, please use our Refer a Case

form.

CareGuard Professional Administration

Learn more about Ametros' professional administration service, CareGuard.

CareGuard Portal

Login to the Ametros CareGuard member portal here.

Resource Center

Learn more about Workers' Compensation, Medicare Set-Asides and Ametros'

services, and more.