Would you buy a house if you didn’t know its price or the ongoing cost of your mortgage? It seems like a ridiculous question, but many claimants are asked to make decisions of the same magnitude on the non- Medicare covered portion of their settlements with little to no reliable information.

Most of the time, claimants don't know the current cost of their medical treatment nor the future expected increases. While a Medicare Set Aside may provide a vote of confidence to the claimant for the MSA portion of their settlement, given Medicare approves the amount, the costs that would not be covered by Medicare (also known as “non-qualified costs”) can be particularly daunting.

Many adjusters try to avoid addressing the issue of non-Medicare covered items altogether in a settlement, but often times it is a necessary component of the offer and a very contentious one. Estimating the pricing on big-ticket items, such as facility costs, custodial care service and home health care can be extremely difficult and often result in many cases never reaching settlement. Working with a hands-on professional administration company, like CareGuard, you can gain transparency into real- world pricing for these items and reach a definitive number for the costs.

What are some of the most significant non-Medicare covered expenses?

What are some of the most significant non-Medicare covered expenses?

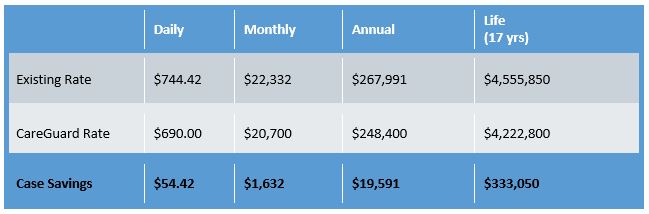

In this case, CareGuard was able to negotiate a rate with the facility that was about $54 a day below what the carrier had been paying. This reduced rate over 17 years generated a significant savings that allowed the carrier and claimant to find a middle ground and to settle the case.

In this case, CareGuard was able to negotiate a rate with the facility that was about $54 a day below what the carrier had been paying. This reduced rate over 17 years generated a significant savings that allowed the carrier and claimant to find a middle ground and to settle the case. Non-Medicare covered expenses will continue to become more significant components of settlements. Reports indicate that home health attendant costs have risen between 1-2% over the past 5 years, nursing facility costs have risen approximately 4% per year, and that in last year alone, rates for adult day care rose almost 6% nationwide.* There is also enormous price inflation and variance in the cost of the prescriptions. These challenges are not going away anytime soon. As the parties to a settlement try to come to a resolution, knowing and using real-world pricing through a platform such as CareGuard can help bridge the gap.

Don’t let the discrepancy in estimates of non-Medicare costs become a huge sticking point in your negotiations. Instead, introduce visibility into the cost and let a professional administrator like CareGuard help get everyone on the same page so the claimant can feel confident that they’ve made an informed choice when they settle their case.

*Source:

Genworth 2015 Cost of Care Survey https://www.genworth.com/aging-and-you/resources.html

Non-Medicare covered expenses will continue to become more significant components of settlements. Reports indicate that home health attendant costs have risen between 1-2% over the past 5 years, nursing facility costs have risen approximately 4% per year, and that in last year alone, rates for adult day care rose almost 6% nationwide.* There is also enormous price inflation and variance in the cost of the prescriptions. These challenges are not going away anytime soon. As the parties to a settlement try to come to a resolution, knowing and using real-world pricing through a platform such as CareGuard can help bridge the gap.

Don’t let the discrepancy in estimates of non-Medicare costs become a huge sticking point in your negotiations. Instead, introduce visibility into the cost and let a professional administrator like CareGuard help get everyone on the same page so the claimant can feel confident that they’ve made an informed choice when they settle their case.

*Source:

Genworth 2015 Cost of Care Survey https://www.genworth.com/aging-and-you/resources.html

What are some of the most significant non-Medicare covered expenses?

What are some of the most significant non-Medicare covered expenses?

- Long Term Skilled Nursing Facilities

- Home health aides and custodial care services

- Home modifications

- Certain creams, gels & compounds (Lidocaine, Voltaren, )

- Transportation

- Medical supplies sold over the counter

- DME bathroom supplies

- Services like acupuncture, gym memberships, home IV therapy

In this case, CareGuard was able to negotiate a rate with the facility that was about $54 a day below what the carrier had been paying. This reduced rate over 17 years generated a significant savings that allowed the carrier and claimant to find a middle ground and to settle the case.

In this case, CareGuard was able to negotiate a rate with the facility that was about $54 a day below what the carrier had been paying. This reduced rate over 17 years generated a significant savings that allowed the carrier and claimant to find a middle ground and to settle the case. Non-Medicare covered expenses will continue to become more significant components of settlements. Reports indicate that home health attendant costs have risen between 1-2% over the past 5 years, nursing facility costs have risen approximately 4% per year, and that in last year alone, rates for adult day care rose almost 6% nationwide.* There is also enormous price inflation and variance in the cost of the prescriptions. These challenges are not going away anytime soon. As the parties to a settlement try to come to a resolution, knowing and using real-world pricing through a platform such as CareGuard can help bridge the gap.

Don’t let the discrepancy in estimates of non-Medicare costs become a huge sticking point in your negotiations. Instead, introduce visibility into the cost and let a professional administrator like CareGuard help get everyone on the same page so the claimant can feel confident that they’ve made an informed choice when they settle their case.

*Source:

Genworth 2015 Cost of Care Survey https://www.genworth.com/aging-and-you/resources.html

Non-Medicare covered expenses will continue to become more significant components of settlements. Reports indicate that home health attendant costs have risen between 1-2% over the past 5 years, nursing facility costs have risen approximately 4% per year, and that in last year alone, rates for adult day care rose almost 6% nationwide.* There is also enormous price inflation and variance in the cost of the prescriptions. These challenges are not going away anytime soon. As the parties to a settlement try to come to a resolution, knowing and using real-world pricing through a platform such as CareGuard can help bridge the gap.

Don’t let the discrepancy in estimates of non-Medicare costs become a huge sticking point in your negotiations. Instead, introduce visibility into the cost and let a professional administrator like CareGuard help get everyone on the same page so the claimant can feel confident that they’ve made an informed choice when they settle their case.

*Source:

Genworth 2015 Cost of Care Survey https://www.genworth.com/aging-and-you/resources.html