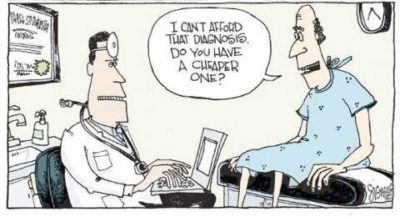

When is the last time you haggled with your doctor over pricing?

It’s certainly not a negotiation most Americans are prepared for or would even know how to approach. However, when it comes to workers compensation settlements, the system anticipates that after settlement injured workers can persuade their doctors to bill them fairly, according to their state’s fee schedule. In reality, the system is naive and injured workers are instead being unfairly stripped of their settlement funds because they are routinely overpaying for treatment.

Injured workers deserve better, and engaging a professional administration service, like CareGuard, provides them just that. CareGuard offers injured workers a sophisticated advocate and group-buying power to make sure they can navigate the healthcare system and get the lifetime of treatment they were promised in their settlement, with money to spare.

The end result is that, in most instances, when injured workers are left on their own after settlement, they fail to manage their care appropriately. They overpay for treatments and drugs, depleting their funds more rapidly than expected. They lose track of bills and fail to comply with regulations putting their Medicare and other benefits at risk. And even when they are aware they can negotiate, injured workers are left to haggle out pricing on their own, pitted against a complex and apathetic medical system. Keep in mind that most of these individuals have far more healthcare needs than the average person.

Professional administration services provide access to discounted drug, provider, and medical equipment pricing, as well as access to technology that provides a hassle-free experience with medical care, and support from a dedicated team of representatives and advocates to answer questions and help the injured worker navigate their medical care. With professional administration, there is no utilization review or the requirement to use a medical provider network (MPN); instead, injured workers can see any providerthey would like, giving them the freedom to get the care they need with the added support to help minimize administrative red tape.

The culmination of all these benefits is that professional administration helps alleviate injured worker’s concerns about settling their case. It is a tool that can help everyone at the settlement table prepare the claimant for post-settlement success and minimize any backlash or misunderstandings after settlement.

Professional administration is often overlooked due to a common misconception that is very expensive, costing tens of thousands of dollars. At CareGuard, our pricing is typically below $3,000 and can be even less for smaller cases. As a result of our low pricing and the high discounts we offer our members, we also find that, on average, we save the injured worker over five times the cost of our services each year.

The workers’ compensation system was built to protect injured workers. Significant work and resources are dedicated to ensuring the system runs well. However, the system was poorly designed to care for injured workers who have settled their case and exited the system. Professional administrators, like CareGuard, pick up where the system left off and ensure the injured workers a smooth transition to life post-settlement.

For more information on CareGuard’s services, please visit https://ametros.com/careguard or call 1-877-905- 7322.

Ametros Financial Corporation (“Ametros") provides cost containment and professional administration services for Medicare Set-Asides (MSAs), medical custodial accounts (non-MSA accounts), special needs trusts, and life care plans with the industry’s first automated, patented and affordable solution. Mixing simplicity and savings for the claimant with risk mitigation for all parties, Ametros’ CareGuard product facilitates settlements and its own growth as the nation’s premier professional administration company. Utilizing cutting-edge technology, continuous innovation, and world-class service, we enable those seeking medical care to live happier, healthier, and more productive lives. Our depth of expertise in the insurance and healthcare industries has positioned us to develop the best product in the marketplace f o r managing medical treatment, ensuring regulatory compliance, and solving complex billing and payment issues in the healthcare world.